The 20-Second Trick For Customize House Online

A Biased View of Customize House Online

Table of ContentsIndicators on Customize House Online You Should Know4 Simple Techniques For Customize House OnlineGetting My Customize House Online To WorkUnknown Facts About Customize House Online

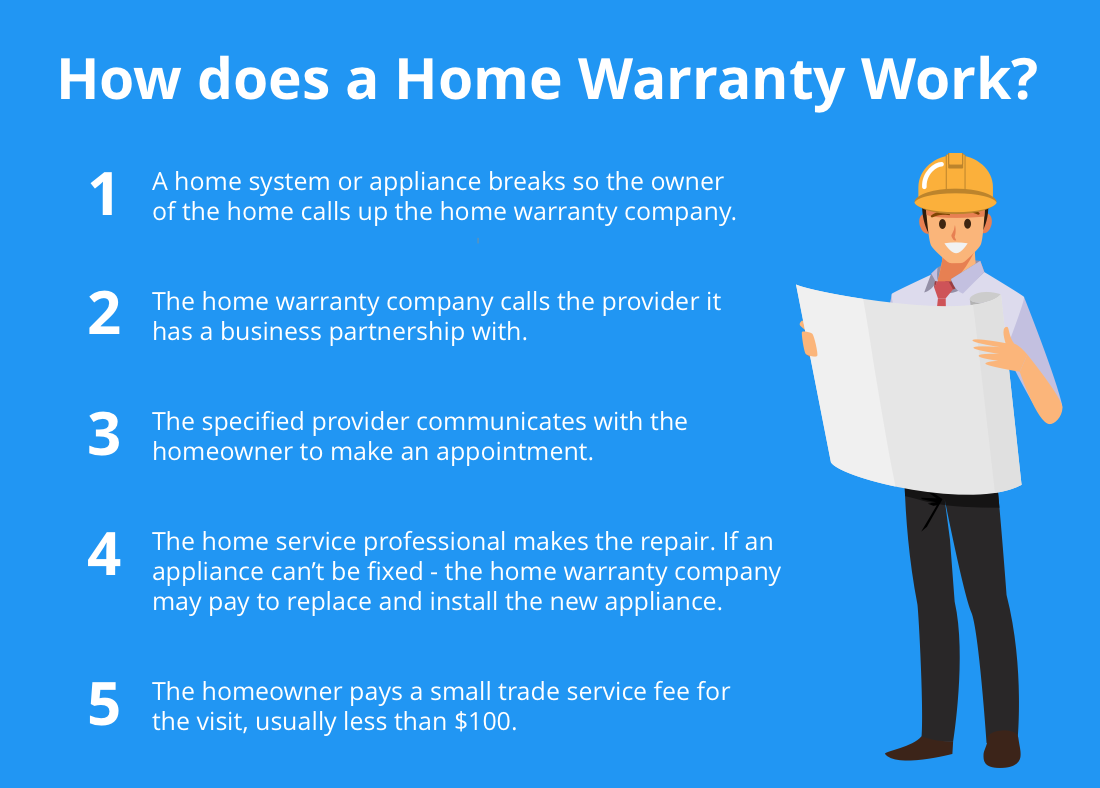

Licensed service warranty firms have a Construction Professionals Board (CCB) license number. We can validate that number for you. Supply us with copies of document or documentation you get from the firm so we can assist them adhere to the law.Have you ever before questioned what the difference was in between a home guarantee and also home insurance policy? Do you require both a home service warranty as well as house insurance policy, or can you obtain just one? A residence warranty protects a residence's internal systems and home appliances.

If the system or device is covered under the property owner's home guarantee strategy, the house guarantee company will send a specialist who concentrates on the repair of that certain system or device. The property owner pays a flat price solution call cost (typically between $60-$100, depending on the residence service warranty business) to have the specialist come to their residence as well as identify the problem.

The smart Trick of Customize House Online That Nobody is Discussing

Residence insurance policy may also cover medical costs for injuries that people received by getting on your property. A property owner pays a yearly costs to their homeowner's insurer. Typically, this is someplace between $300-$1,000 a year, depending on the plan. When something is damaged by a disaster that is covered under the house insurance coverage policy, a house owner will certainly call their residence insurance company to sue.

Homeowners will typically have to pay a deductible, a set amount of cash that appears of the home owner's budget before the home insurance firm pays any kind of money in the direction of the insurance claim - web link customize house online. A house insurance coverage deductible can be anywhere in between $100 to $2,000. Usually, the higher the insurance deductible, the reduced the yearly costs cost.

Customize House Online Things To Know Before You Buy

What is the Difference In Between House Warranty as well as Residence Insurance Policy A house service warranty contract and a residence insurance coverage run in comparable ways. Both have a yearly costs and also an insurance deductible, although a residence insurance premium and also deductible is often much more than a home guarantee's. The major distinctions between home service warranties and also home insurance coverage are what they cover.

An additional distinction between a home guarantee and also home insurance policy is that home insurance coverage is generally required for property owners (if they have a home loan on their residence) while a residence service warranty strategy is not called for. A residence service warranty and also residence insurance policy provide protection on different parts of a house, as well as together they can safeguard a house owner's spending plan from pricey repair work when they unavoidably crop view up.

If there is damages done to the structure of the house, the owner won't need to pay the high expenses to repair it if they have home insurance policy. If the damages to the house's structure or property owner's valuables was produced by a malfunctioning devices or systems, a house guarantee can aid to cover the pricey repairs or substitute if the system or home appliance has fallen short from typical deterioration.

They will collaborate to offer protection on every component of your home. If you want buying a home warranty for your residence, take a look at Spots's home service warranty plans and also pricing below, or demand a quote for your home here.

Customize House Online for Dummies

"Nonetheless, the more systems you include, such as pool protection or an added heating unit, the higher the expense," she states. Includes Meenan: "Rates are typically flexible as well." Aside from the yearly fee, homeowners can sites expect to pay generally $100 to $200 per solution call visit, depending upon the kind of contract you buy, Zwicker notes.

"We paid $500 to authorize up, and afterwards had to pay one more $300 to clean the main sewer line after a shower drain back-up," says the Sanchezes. With $800 out of pocket, they believed: "We really did not profit from the residence warranty whatsoever." As a young couple in another home, the Sanchezes had a challenging experience with a home service warranty.

When the service technician wasn't pleased with an analysis he got while checking the heating system, they state, the company would certainly not accept protection unless they paid to replace a $400 part, which they did. While this was the Sanchezes experience years earlier, Brown validated that "checking every major appliance before providing coverage is not a sector requirement."Always ask your provider for clearness.